|

A credit score is a number number that lenders use to determine risk. Essentially, your score tells a lender how likely you are to pay them back in full and on time. And it's really important, this number determine if a lender will let you borrow money, but also the amount, terms and flexibility the lender will offer you.

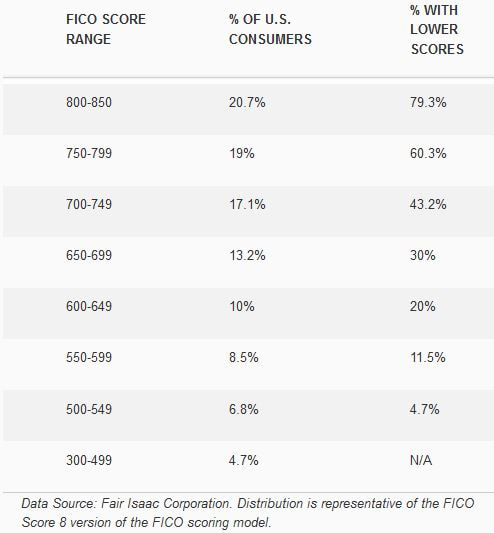

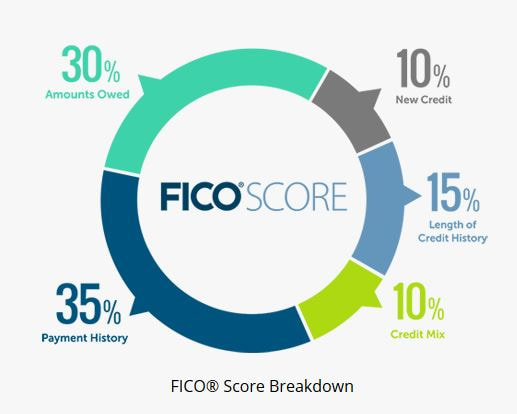

A FICO score is comprised of five major factors, although some are weighted more heavily than others, such as payment history and debt owed. Here’s the breakdown: Payment history: Your account payment information, including any delinquencies and public records. Amounts owed: How much you owe on your accounts. The amount of available credit you’re using on revolving accounts is heavily weighted. Length of credit history: How long ago you opened accounts and the time since account activity. Credit mix: The mix of accounts you have, such as revolving and installment. New credit: Your pursuit of additional credit, including credit inquiries and the number of recently opened accounts. A better credit score improves our ability to borrow and satisfy those like our landlord who want us to be creditworthy. Improving credit isn't an immediate process. An excellent credit score is most often the result of years of conscientious financial behavior. While some strategies will let you see small improvements quickly, joining the ranks of those with the highest credit scores will take time. Questions? Call us today! If you don’t think that your FICO® scores are important, think again. The interest rate you can expect to pay for a loan is dependent on these scores. The difference between a FICO® score of 620 and 760 can often be tens of thousands of dollars over the life of your loan. A low score can cost you money each month or even cause the home you want to be unaffordable. Basically, the higher your FICO® scores the less you can expect to pay for your mortgage loan. Learn to take control of your FICO® score and save money on your mortgage payments. FICO scores range from 300 to 850. If all three FICO scores are viewed on the same day they will typically vary between zero and fifty points. The purpose of the score is to predict the likelihood of 90+ day delinquency over the next 24 months. As of (April 2017) data, the national distribution of FICO credit scores is as follows: The General Formula for FICO Scores FICO Credit Score Tidbits

Payment History When assigning points gained or lost for payment history information, the FICO score looks at four separate components:

Here is how Fair Isaac assigns the severity of a credit problem according to the time it has been on a credit bureau: Percent Negative Impact Most recent 12 months 93% Prior 12 to 24 months 60% Prior 24 to 36 months 44% Prior 36 to 48 months 33% Older than 4 years 22% Source: Credit Scores & Credit Reports, Evan Hendricks, Privacy Times, Inc Capacity is King Almost as important as how you pay your bills is the amount owed on your various accounts (i.e. capacity), The FICO model considers three separate components of your credit when assigning capacity points= 1. Your installment balances compared to the original loan amounts. 2. Your revolving account balance compared to your revolving credit limit on an account-by-account basis; and 3. Your total revolving account balances compared to your total revolving limits. By far, the total revolving limits available (#3 above) carries the most potential points and the potential loss of points. Why does capacity carry so much weight in tie FICO scoring model? Because the FICO model knows that the majority of Americans who go bankrupt charge up their cards to the limits before they file. In order to understand capacity, you must understand the math problem that determines how this large number of points is gained or lost. % Revolving Dollars Available on Total Revolving Accts. Available Total Reported Limits on Revolving Accts. Keys to Capacity Success

Strategies that Will Improve a FICO Score

Checking your credit rating before you talk to a lender when purchasing your home will give you time to correct reporting errors and to prepare your score. I help clients to make informed decisions when pursuing the dream to buy a home. Contact me and we'll get you started! Iveth Caruso Providing the most professional, dedicated, informative and loyal service you can find in Real Estate! Disclaimer: All information provided is deemed reliable, but is not guaranteed and should be independently verified.

|

Categories

All

The information on this site is intended to be a free resource to provide general information to the public. The information is intended to supplement instruction from your legal, financial or real estate adviser. The information contained on this site should never be taken as a substitute for legal or financial advice from a licensed professional.

Archives

October 2021

|

Cell: 706.530.1114

Iveth Caruso Real Estate™ ©2017 All rights reserved. LoKation Real Estate is licensed in Georgia

Your Home, Your Dream, My Mission!

God, Family, then Business.