|

If you’re serious about purchasing a home, getting a pre-approval letter should be one of your first steps in the home-buying process. It is fundamental to obtain a pre-approval letter before you even begin visiting properties. You may have a hard time getting the attention of home sellers or even real estate agents. The pre-approval involves choosing a mortgage lender and a loan program and providing some basic information.

For most lenders the pre-approval process is really simple–they’ll ask you about your income, debts and assets, and they’ll calculate a maximum loan amount and purchase price based on that information. Loan officers may not verify your information or check your credit rating. Other lenders will be much more thorough – there is no industry standard for pre-qualification. highly recommend all of my buyers to present not only an earnest check, but also a pre-approval letter and if it’s a cash offer, a copy of a recent bank statement showing they have proof of funds to close. When you make an offer and an agent receives it with these documents attached (which is almost standard procedure); the real estate agent immediately has more confidence that you are qualified and really intend to close the transaction; in other words you are showing you are a serious buyer. Lastly, a pre-approval provides you as a buyer vital information as to what price range you should stay within as well as the range of yearly taxes. A real estate agent who requests a pre-approval prior to showing a buyer homes is trying to save you time and frustration. As a buyer, a pre-approval letter provides you and edge and purchasing power, especially in a multiple offer situation. If an agent asks if you’re pre-approved, it's a good sign. Because it shows that they are thorough and thoughtful about how they do their business. That is the type of agent you want to have on your side when you’re buying a house, one agent who pays attention to the details. One who isn’t going to waste your time or allow your heart to be broken when you fall in love with a house you can’t do anything about. If you are ready to buy a home, contact me for a free consultation.

0 Comments

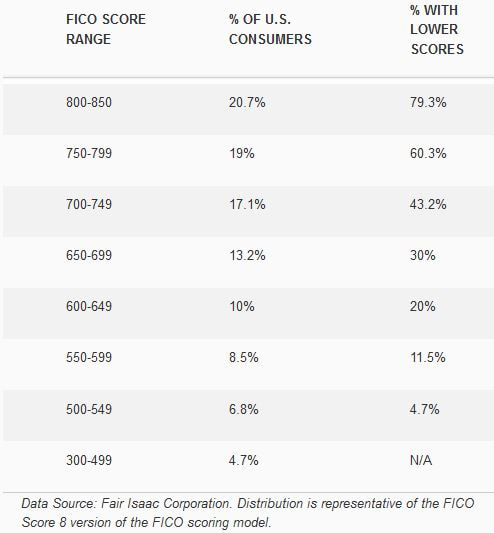

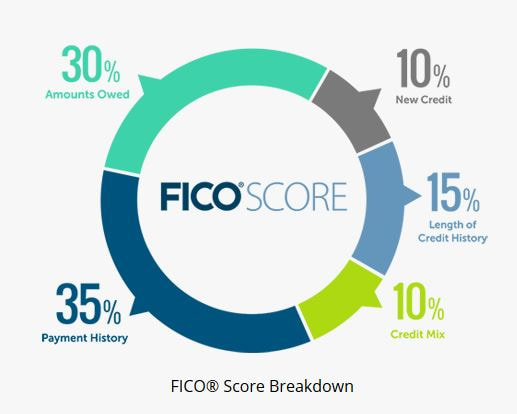

If you don’t think that your FICO® scores are important, think again. The interest rate you can expect to pay for a loan is dependent on these scores. The difference between a FICO® score of 620 and 760 can often be tens of thousands of dollars over the life of your loan. A low score can cost you money each month or even cause the home you want to be unaffordable. Basically, the higher your FICO® scores the less you can expect to pay for your mortgage loan. Learn to take control of your FICO® score and save money on your mortgage payments. FICO scores range from 300 to 850. If all three FICO scores are viewed on the same day they will typically vary between zero and fifty points. The purpose of the score is to predict the likelihood of 90+ day delinquency over the next 24 months. As of (April 2017) data, the national distribution of FICO credit scores is as follows: The General Formula for FICO Scores FICO Credit Score Tidbits

Payment History When assigning points gained or lost for payment history information, the FICO score looks at four separate components:

Here is how Fair Isaac assigns the severity of a credit problem according to the time it has been on a credit bureau: Percent Negative Impact Most recent 12 months 93% Prior 12 to 24 months 60% Prior 24 to 36 months 44% Prior 36 to 48 months 33% Older than 4 years 22% Source: Credit Scores & Credit Reports, Evan Hendricks, Privacy Times, Inc Capacity is King Almost as important as how you pay your bills is the amount owed on your various accounts (i.e. capacity), The FICO model considers three separate components of your credit when assigning capacity points= 1. Your installment balances compared to the original loan amounts. 2. Your revolving account balance compared to your revolving credit limit on an account-by-account basis; and 3. Your total revolving account balances compared to your total revolving limits. By far, the total revolving limits available (#3 above) carries the most potential points and the potential loss of points. Why does capacity carry so much weight in tie FICO scoring model? Because the FICO model knows that the majority of Americans who go bankrupt charge up their cards to the limits before they file. In order to understand capacity, you must understand the math problem that determines how this large number of points is gained or lost. % Revolving Dollars Available on Total Revolving Accts. Available Total Reported Limits on Revolving Accts. Keys to Capacity Success

Strategies that Will Improve a FICO Score

Checking your credit rating before you talk to a lender when purchasing your home will give you time to correct reporting errors and to prepare your score. I help clients to make informed decisions when pursuing the dream to buy a home. Contact me and we'll get you started! Iveth Caruso Providing the most professional, dedicated, informative and loyal service you can find in Real Estate! Disclaimer: All information provided is deemed reliable, but is not guaranteed and should be independently verified.

Iveth Caruso, your KW REALTOR in the North Atlanta Area

Iveth Caruso, your REALTOR in the North Atlanta Area

Iveth Caruso, your REALTOR in the North Atlanta Area

|

Categories

All

The information on this site is intended to be a free resource to provide general information to the public. The information is intended to supplement instruction from your legal, financial or real estate adviser. The information contained on this site should never be taken as a substitute for legal or financial advice from a licensed professional.

Archives

October 2021

|

Cell: 706.530.1114

Iveth Caruso Real Estate™ ©2017 All rights reserved. LoKation Real Estate is licensed in Georgia

Your Home, Your Dream, My Mission!

God, Family, then Business.