|

The real estate industry has been in a constant state of change since the pandemic began in early 2020. It has become incredibly difficult to predict what’s going to happen next with all of the policy changes happening overnight. Luckily, Homelight has been conducting online real estate agent surveys to learn about market trends and what agents are seeing in the field. Their summer / fall 2021 survey polled over 1,100 agents and revealed some interesting insights for how the real estate market will look for the rest of 2021. 1. Buyers can’t handle the outlandish prices According to Homelight’s Top Agent Insights Summer / Fall 2021 Report, 54.4% of agents experienced or knew an agent who experienced a buyer backing out of purchase contracts because of second thoughts about the price. Typically, this would occur after an intense bidding war causing the buyer to bid over their budget and secure the listing. Although they were motivated to win the bidding war, they couldn’t stomach the price in the following weeks and backed out of the contract. This is resulting in many homes going back on the market with a “stigma that something is wrong with it,” but in reality, buyers just can’t handle the outlandish prices. 2. Buyers are seeking more affordable housing because of bidding wars. With the slight increase of inventory, the buyer landscape is quickly changing. According to the report, “agents who say ‘bidding wars in my market are on the rise’ declined to 37% — down from 52% the quarter prior.” This was the first decline of this statistic since Q4 2020. The report also shows that “agents who say bidding wars are at their peak grew from 42% to 54%,” which means intense bidding wars may not be as apparent in the coming months. Victoria Ro is an agent in the western D.C. suburbs and she says listings that usually garner 20+ offers are only getting around 5 now. 3. Sellers aren’t as afraid of COVID-19 anymore. One of the biggest impacts of COVID-19 was not being able to have open houses because many homeowners didn’t want to contract the virus. As the vaccine rolled out across the country, the pandemic fears began to subside for sellers and 45.4% of agents saw that sellers didn’t have as many health concerns about putting their home on the market. This may bring a slew of inventory into the market in the coming months. 4. Construction costs are still on the rise.

Framing lumber is an essential resource for building houses. According to the report, the cost of framing lumber rose from $350 to $1200 throughout the last year and this would add almost $36,000 to the value of an average new home. The report also references a recent study from the NAR that shows there has been an “underbuilding gap of 5.5 to 6.8 million housing units since 2001.” These statistics show that the price of home construction will continue to increase home prices this year unless there is a government assistance program. 5. Cash is still king. Despite low interest rates bringing in a plethora of buyers into the market, sellers will always seek out the cash offers first. According to Homelight’s report, 30.1% of agents say buyers want to participate in the market right now because of low interest rates. These buyers are extremely motivated, but a cash offer will always trump a bid that is financed. Click here to read Homelight’s full report! Whether you want to buy or sell a home locally or globally, I can help you finding or selling your home so you can create the life you love! ☎️ 706.530.1114 or email us. Have a great day! Iveth Caruso Fall’s cooler temps are perfect for deck and yard improvements. Stain the Deck Help your deck field what winter throws at it by re-staining it this month. September's cooler temps and lower humidity make it the ideal time for this project. Check Fire Extinguishers According to the Red Cross, fires increase in the fall and winter. Keep your home fire safe by getting your fire extinguishers checked by a certified professional. Fire extinguishers do break down and malfunction. In fact, after six years they need to be emptied and reloaded. If you haven't already, buy one for each floor — and the garage. Spruce Up the Yard Aerate your lawn, reseed or fertilize it if needed, and plant perennials and shrubs (often on sale now). Your lawn will green up faster after winter, and the shrubs and perennials will have a chance to establish roots before the first freeze. Inspect Your Home's ExteriorSpending money on roof repairs is no party, but neither is handing out buckets to the family to catch leaks in a winter storm. Inspect your roof — and other big-ticket items, like siding, grading, and gutters — before you've got problems. You'll cut costs by fixing them now and stay dry and warm all winter long. Whether you want to buy or sell a home locally or globally, I can help you finding or selling your home so you can create the life you love! ☎️ 706.530.1114 or email us. Have a great day! Iveth Caruso Source:houselogic.com/organize-maintain/home-maintenance-tips/september-home-maintenance-plan/

More homes are coming onto the market and as they do, home buyers are eager to snatch them up. Existing-home sales—completed transactions that include single-family homes, townhomes, condos, and co-ops—increased 2% in July compared to June, reaching a seasonally adjusted annual rate of 5.99 million, the National Association of REALTORS® reported Monday. Sales are up 1.5% compared to a year ago. As more homes enter the marketplace, opportunities for prospective buyers continue to increase in regions across the country, said NAR President Charlie Oppler. Housing inventories increased 7.3% in July compared to June, reaching 1.32 million homes for sale. “We see inventory beginning to tick up, which will lessen the intensity of multiple offers,” said Lawrence Yun, NAR’s chief economist. “Much of the home sales growth is still occurring in the upper-end markets, while the mid- to lower-tier areas aren’t seeing as much growth because there are still too few starter homes available.” But home prices continue to surge. The median existing-home price for all housing types in July was $359,900, an increase of nearly 18% compared to a year ago. “Although we shouldn’t expect to see home prices drop in the coming months, there is a chance that they will level off as inventory continues to gradually improve,” Yun said. “In the meantime, some prospective buyers who are priced out are raising the demand for rental homes and thereby pushing up the rental rates.” Here’s a closer look at additional housing indicators from NAR's July housing report: Days on the market: Properties typically remained on the market for 17 days in July, down from 22 days a year ago. Eighty-nine percent of homes sold in July were on the market for less than a month. First-time buyers: First-time buyers comprised 30% of sales in July, down from 34% in July 2020. All-cash buyers: All-cash sales accounted for 23% of transactions in July, up from 16% in July 2020. Individual investors or second-home buyers comprise the majority of cash sales. They purchased 15% of homes in July, unchanged from the 15% seen in July 2020. Regional Breakdown Here’s how existing-home sales fared across the country in July:

Whether you want to buy or sell a home locally or globally, I can help you finding or selling your home so you can create the life you love! ☎️ 706.530.1114 or email us. Have a great day! Iveth Caruso Source: https://magazine.realtor/daily-news/2021/08/23/

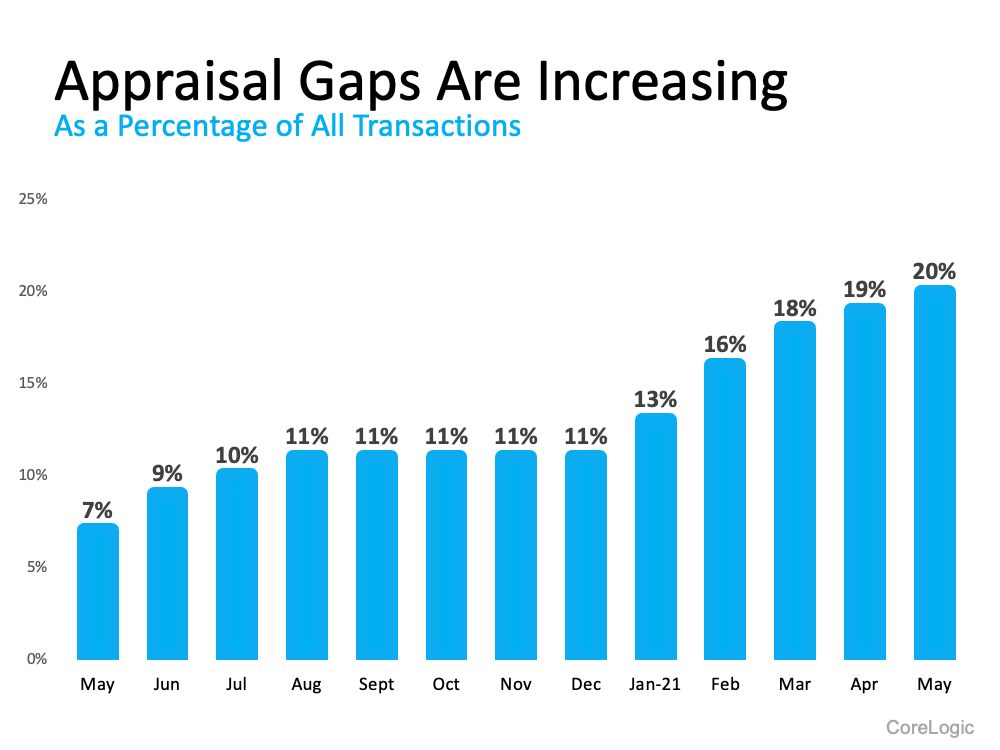

When supply is low and demand is high, prices rise. That’s what’s happening in today’s housing market. Home prices are appreciating at near-historic rates, and that’s creating some challenges when it comes to home appraisals. It’s become increasingly common for an appraisal to come in below the contract price on the house. Because buyers are paying prices above listing price and higher than the market data available to appraisers to support a higher appraisal value. This difference is known as “the appraisal gap”. Basically, with the heightened buyer demand, purchasers are often willing to pay over asking to secure their new home. When the appraiser comes in, they look at things a bit more objectively. Their job is to assess the inherent value of the home, so they’re going to study the facts and use the data available to them. Their goal is to make sure the lender isn’t loaning more money than the home is worth. It’s objective, rather than emotional. The best thing a buyer can do is understand how appraisal gaps may impact your transaction if you’re buying or selling. If you do encounter an appraisal below your contract price, know that in today’s sellers’ market, the most common approach is for the seller to ask the buyer to make up the difference in price. Buyers, be prepared to bring extra money to the table if you really want the home.

Above all else, lean on your real estate agent. Whether you’re a buyer or seller, your trusted advisor is your ally if you come up against an appraisal gap. We’ll help you understand your options and handle any additional negotiations that need to happen. Whether you want to buy or sell a home locally or globally, I can help you finding or selling your home so you can create the life you love! ☎️ 706.530.1114 or email us. Have a great day! Iveth Caruso A credit score is a number number that lenders use to determine risk. Essentially, your score tells a lender how likely you are to pay them back in full and on time. And it's really important, this number determine if a lender will let you borrow money, but also the amount, terms and flexibility the lender will offer you.

A FICO score is comprised of five major factors, although some are weighted more heavily than others, such as payment history and debt owed. Here’s the breakdown: Payment history: Your account payment information, including any delinquencies and public records. Amounts owed: How much you owe on your accounts. The amount of available credit you’re using on revolving accounts is heavily weighted. Length of credit history: How long ago you opened accounts and the time since account activity. Credit mix: The mix of accounts you have, such as revolving and installment. New credit: Your pursuit of additional credit, including credit inquiries and the number of recently opened accounts. A better credit score improves our ability to borrow and satisfy those like our landlord who want us to be creditworthy. Improving credit isn't an immediate process. An excellent credit score is most often the result of years of conscientious financial behavior. While some strategies will let you see small improvements quickly, joining the ranks of those with the highest credit scores will take time. Questions? Call us today! |

Categories

All

The information on this site is intended to be a free resource to provide general information to the public. The information is intended to supplement instruction from your legal, financial or real estate adviser. The information contained on this site should never be taken as a substitute for legal or financial advice from a licensed professional.

Archives

October 2021

|

Cell: 706.530.1114

Iveth Caruso Real Estate™ ©2017 All rights reserved. LoKation Real Estate is licensed in Georgia

Your Home, Your Dream, My Mission!

God, Family, then Business.